The changing state of the shelf: Coping with uncertainty

The COVID-19 pandemic severely impacted US brands and retailers in 2020. From supply-chain disruptions, field-labor shortages, and changing channel dynamics, to significant shifts in consumer behavior, it was a year of uncertainties like never before.

To help brands cope with change and see how the retail situation has evolved by early 2021, Trax used on-shelf availability (OSA) captured with its Computer Vision technology to find out the state of shelf today, particularly for the categories that were most out of stock (OOS) in 2020. It also looked at shelf availability for these brand categories today, compared to how it was during the peak of the pandemic buying frenzy last year.

The data was collected using autonomous shelf monitoring solutions such as robots and dome and shelf edge cameras to collect images. These images were then turned into data using image-recognition technology capable of distinguishing one SKU from another.

Ten product categories in more than 300 stores around the US were measured between 1-12 April 2020 and then again between the last week of March and the first week of April 2021. Based on the OSA data extracted from more than 50,000 images each time, here’s what brands and retailers can learn so that they can be better prepared for times of uncertainty.

Product availability has improved in 2021

Toilet paper shortages were a symbol of the pandemic, and Trax’s OSA data confirmed this; 80% of stores surveyed in 2020 were completely OOS. A year later, there have not been instances of complete OOS. Stocks of other previously hard to find categories such as baby wipes, disinfectant wipes, and sprays have also recovered substantially. Where 15% of stores had no baby wipes last year, this year, only 3% have had shelves that were two-thirds empty. Meanwhile, more than 80% stores reported over 50% stock availability of disinfectant wipes and sprays in 2021. Last year, only 10% stores had such coverage.

The fact that there were no instances of complete OOS in any of the categories covered shows that CPGs and retailers have bounced back from the worst of the pandemic, managing to get their supply chain and logistics in better order.

Product availability varies by geography and retailer

Neither 2020’s shortages nor 2021’s recovery were evenly distributed across the country. For example, shelves were emptier last year in Arizona, Nevada, and California than they were in Ohio, South Carolina, and Indiana (the latter three states had the highest OSA in the categories we examined).

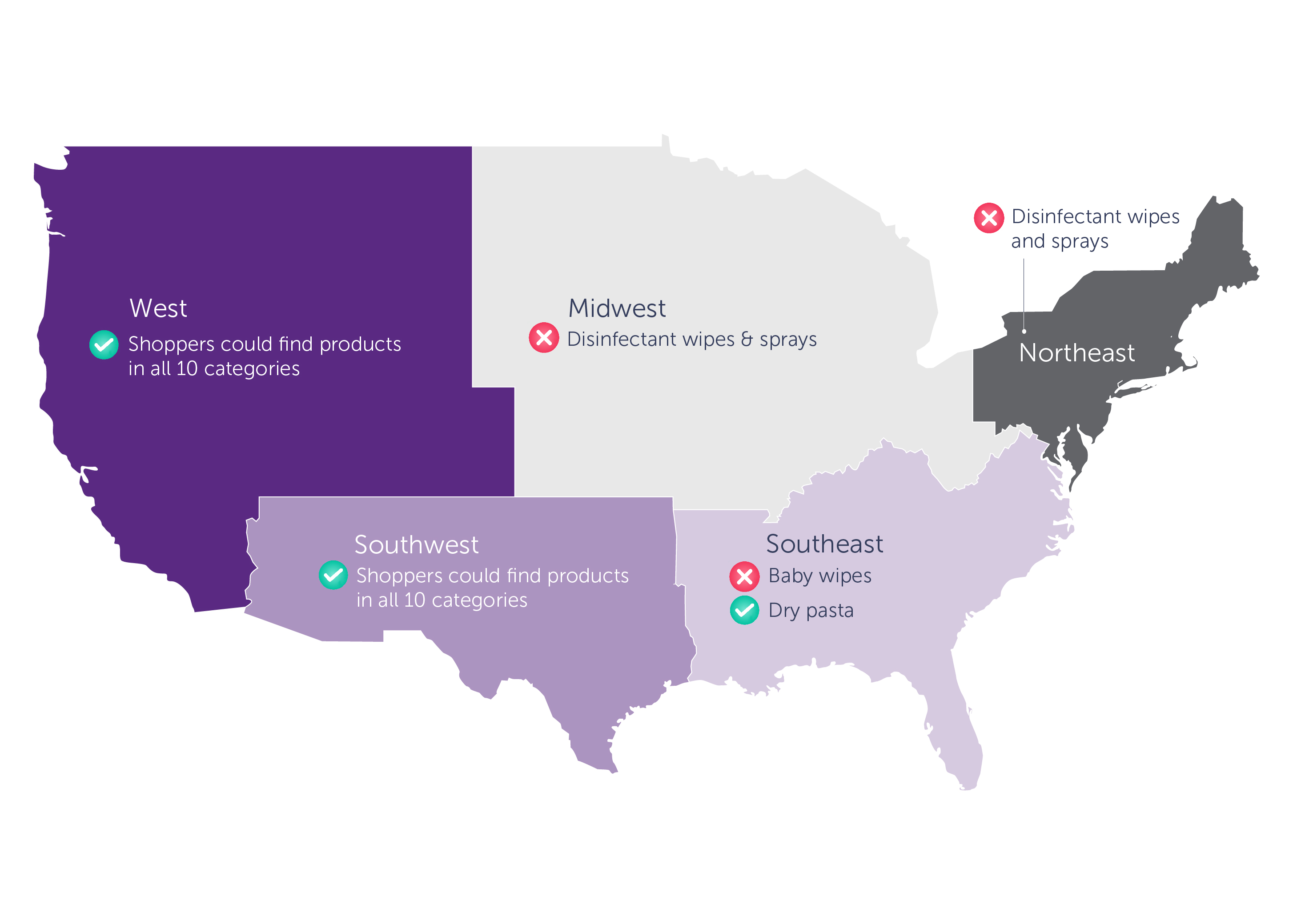

But in March 2021, shoppers in the West and Southwest were highly likely to be able buy the types of products they needed, even though they may have had to compromise on brand or package size.

The only product category with lower supply was disinfectants, but even then, almost two-thirds of stores in the US were stocked at 50% of the usual amounts, while in the Northeast, only 12% of stores had stock levels of 25% or less.

Beyond regional differences, availability also varied by retailers. For example, Acme, Giant, Harris Teeter, Jewel-Osco, and Shaw’s stocked more toilet paper than their competitors. Meanwhile, hand sanitizer was easily available at Hannaford and Jewel-Osco stores, as was cat food at Fred Meyer, Harris Teeter, and Jewel-Osco.

One of the greatest variations between chains could be seen in baby wipes: Walmart stores had less than 25% stock, while Albertsons, Fred Meyer, Hannaford, Jewel-Osco, Shaw’s, and Vons were close to capacity.

What retailers and CPG brands can do

As pandemic restrictions ease, discretionary and essential retail spending is beginning to recover (grocery spending has seen a 25% increase). But there is ongoing uncertainty, as 12% of consumers predict their spending will never fully recover to pre-COVID levels.

To cope with these uncertainties, brands and retailers need the right technology and analytical power to gain visibility of their entire supply-chain, as well as early detection of fluctuations in demand. Technological developments in AI, machine learning, and the Internet of Things mean that track and trace, predictive maintenance, supply-chain visibility, and supplier risk management can become reality. But to achieve it, an ecosystem-wide investment in information technology and data, as well as an agile mindset are needed.

Trax can help by providing real-time visibility of the products available on the shelves at supermarkets and other grocery retailers. This gives brands and retailers the opportunity to proactively order or adjust deliveries and direct stock to stores where it will make the most difference. This data can also be used by CPGs to inform production decisions.

To learn more about product availability and changes in shopper behavior as a result of the pandemic, download our white paper: The new, post-pandemic state of the shelf.