The changing face of beer retailing in the U.S.

The U.S. beer market has been in a state of flux for the past few years. The growth rate in off-premise channels dropped from 5% in 2015 to just 1% in the first six months of 2018. Manufacturers can play smarter by gaining a closer understanding of how this is playing out on the shelf and improving their share of space.

Even as growth is slowing, millennial consumers are demanding new brands, styles and sub-categories. This means more beer brands are competing for the same shelf space, with discerning consumers favoring above-premium beers. In fact, this segment, which includes import, craft and domestic super premium products, has experienced a 4.1% sales growth-year on-year.

Yet another notable trend in the US beer market is the fervor for flavor. Flavored Malt Beverages (FMBs) are growing rapidly, and driving the category. Long dubbed as “malternatives” or “alcopops”, FMBs were considered innovation and high churn. But in its latest avatar, the segment boasts a plethora of low-sugar offerings flavored with a dizzying range of fruits and spirits essences. With the rise of the wellness revolution among consumers, sales of local and regional ciders, as well as new flavor profiles like sour, hazy and juicy ales are climbing steadily.

Just look at Truly Spiked Hard Seltzer (TSHS). Launched in 2016, it achieved 165% sales growth in the first six months of this year and increased distribution by 24%. According to the 2018 Beer Shelf Pulse Report by Trax, Nielsen and Acosta, TSHS also more than doubled its average facings in the stores covered.

But when it comes to changes in the U.S. beer market, consumer taste is only part of the story. While it is par for the course for manufacturers to create new brands and flavors, they are increasingly being called upon to find new ways to make their brands accessible to consumers where it matters - on the shelf.

Shelf positioning: More than meets the eye

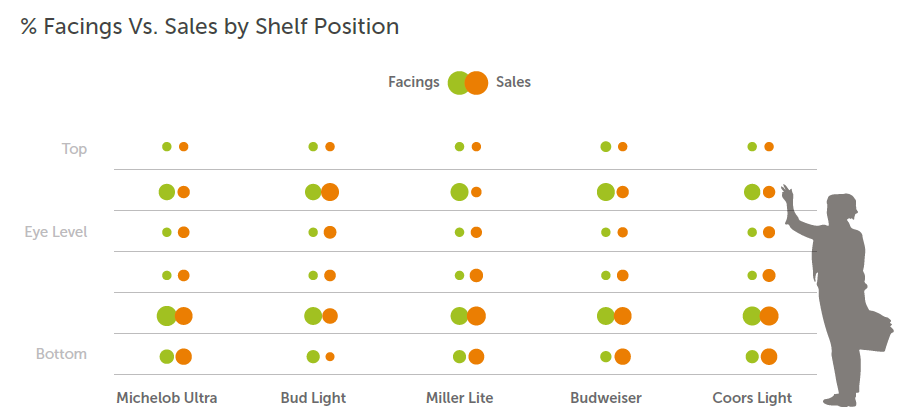

This is where insights into shelf positioning are valuable. Here are some interesting observations from the 2018 Beer Shelf Pulse Report.

The five highest-selling beer manufacturers position their products just above and below eye level, yet the bottom shelves consistently drive higher sales across all brands. Only Bud Light seems to sell well at eye level.

There is a lot more to shelf positioning than meets the eye. Pack sizes also seem to influence consumer purchasing choices. For example, the report shows that sales per facings increased 42%, 46% and 60% for Heineken, Boston Beer and New Belgium Fat Tire respectively when their 12-packs moved from the bottom shelf to eye level.

Finding the perfect mix to improve efficacy of promotions

Display space, much like shelf positioning, is like a constantly evolving game of Tetris. The influx of new brands is making it more difficult for retailers to fit everything into the space available. While top selling brands like Bud Light, Bud, Coors Light, Miller Light and Corona had displays in over 30% of outlets for the first half of 2018, the Beer Shelf Pulse Report found that two-thirds of the actual display space was occupied by smaller brands.

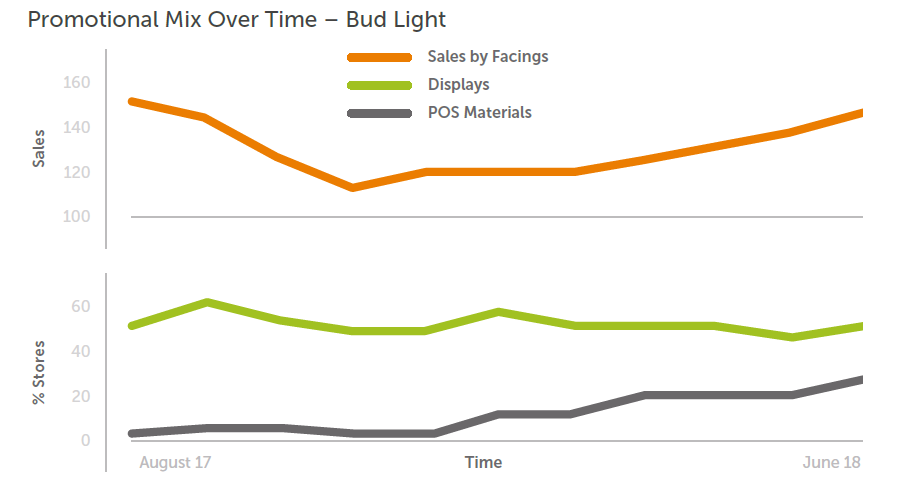

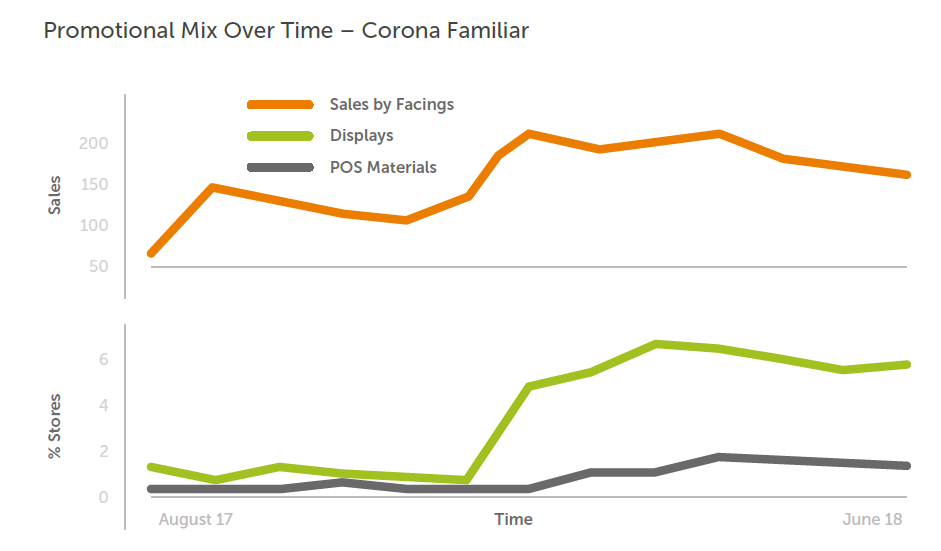

In addition to displays, manufacturers have long relied on POS materials in store to activate promotions and drive more sales. To truly get good return on trade spending, the selection of marketing tactics in-store needs to be scientific and data-driven. For example, the 2018 Beer Shelf Pulse report found that using promotional materials in store has had a strong correlation to sales over time for Bud Light. For Corona, on the other hand, displays are more influential in driving sales.

It’s clear from the data that attracting consumer attention today takes more than just safeguarding “eye level” shelf territory and throwing in some promotional materials. Maintaining fair share of shelf, optimizing facings and finding the right mix of promotional tactics are all now more important than ever. This requires a detailed understanding of what’s happening to brands and pack sizes at each individual outlet and aisle, and on each shelf. It’s this level of granular detail that holds the key for manufacturers who want to unlock that elusive growth in the U.S. beer market today.

Download the full study “The changing face of beer retailing in the U.S.” to learn about how the market is evolving and for insights that can help you stay ahead of the curve.