3 reasons why brands need a constant pulse of in-store conditions

Having continuous visibility into what is happening on the shelf is not just a need for field sales teams anymore. When done right, it benefits everyone — from category managers to shopper marketers and brand managers.

Competitors losing shelf space to each other has been considered a zero-sum game for too long. But the brick and mortar retail landscape today is characterized by fewer stores, more items on the shelf and fewer trips made by shoppers. The clamor for shelf space has led to more new launches, promotions and other retail activity that brands can barely afford to take their eyes off from.

Becoming more shelf aware with integrated in-store data and POS data

A recent POI study found that only 1 in 5 office-based personnel have “analytical capabilities required to make appropriate decisions”. Accurate and timely insights are the order of the day, and advances in in-store technology are enabling this as the industry moves away from manual, infrequent audits, fragmented data and slow reporting processes.

New, innovative market measurement services now combine image recognition and analytics with retail point-of-sale data to not only drastically improve executional outcomes but also provide a holistic view of how in-store conditions impact brand performance – something that both field-based users and office teams can benefit from.

Here are 3 reasons why ongoing, continuous visibility of the shelf is becoming the new retail paradigm.

- Staying on top of competitor activities

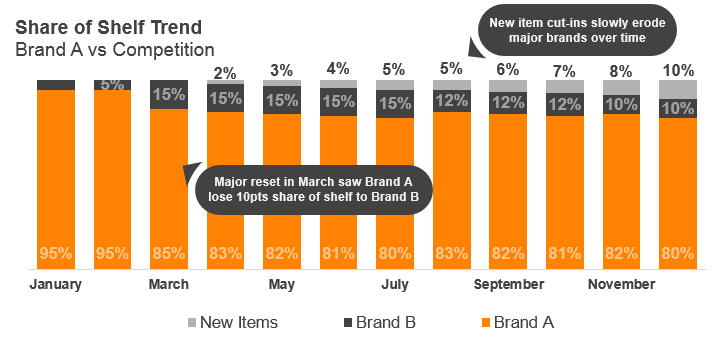

The need to localize store experience is driving more frequent shelf resets. At the same time, rising competition is resulting in more new item cut-ins. This means brands could easily go from owning the category in January to losing a significant share of their shelf by the end of the year. This slow erosion of space over time is extremely hard to track with a one-time manual audit.

Without continuous visibility, it also becomes hard to understand the impact of a reset. According to a Nielsen study, nearly 85% of resets don’t return category growth, and end up having zero impact on sales. Having a constant eye of shelf conditions could help brands measure the impact of resets on sales and replicate winning merchandizing strategy across stores.

- Getting fair share of space for new products

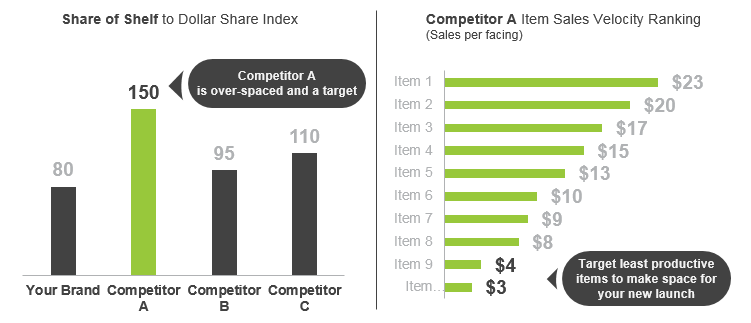

While launching new products, category managers negotiate with retailers for shelf space. Having data on which competitor brands are overspaced and less productive makes it easy to convince retailers to make space for a specific brand’s product ahead of competitors.

Ongoing measurement of store conditions provide a comparative view of a brand’s facings against competitor facings. This share of shelf data when integrated with sales data provides insights on SKU-level productivity and sales rates, allowing category managers to make a data-driven, mutually profitable case for new product space allocation with retailers.

- Improving product placement and display effectiveness

According to Nielsen Retail Measurement Data, CPG companies spend over $37 billion on display activity every year, but often can’t see which promotional programs are executed and how competitors are responding.

Continuous measurement not only informs brands on how many stores carried displays, but also presents actual shelf images for visual proof of activation.

Another key influencer of purchase decisions is product placement. Having the ability to see how many facings are at eye-level could be the difference in making or breaking a sale.

Shelf Pulse by Trax and Nielsen

CPG manufacturers simply cannot afford to be blind to changes in store conditions anymore. Studies show that ongoing measurement helps brands gain a 3–5% uplift in sales.

Watch this video of Shelf Pulse by Trax and Nielsen in association with Acosta to see how your entire team can benefit from a greater and more frequent visibility into what is happening at the shelf.