Consumer packaged goods (CPG) companies pay retailers substantial fees to be in store, improve placement and run promotions. These slotting, display and pay-to-stay fees can quickly add up, impacting your bottom line. In an earlier blog, we discussed how, to achieve ROI on these costs, CPGs must ensure that they get the space they pay for and secure the best possible execution outcomes.

In this blog, we explore how CPGs can use store- and SKU-level execution data to improve ROI and enrich ongoing conversations with retailers.

Ask the right questions

OK, so you’ve paid your retail accounts the money needed to keep your products on shelf and your promotions activated in store. Depending on whether you’re a field sales manager, a trade marketer or a category manager, your brand’s main goals at the shelf may be to:

Achieving these goals requires data that helps you carry out tactical activities like compliance checks, as well as conduct strategic analyses to answer more nuanced questions involving multiple sales levers in the store.

Am I getting compliance right:

Compliance metrics, such as on-shelf availability (OSA), share of shelf and shelf positioning are essential for firstly ensuring you’re getting what you paid for, and then to recommend to your field sales teams what corrective actions to prioritize during store visits. As this data accumulates over time, it also allows you to lower costs of doing business. For example, if you find that you are not getting the distribution you paid for, you could suggest changing fulfillment methods or argue for using your own supply chain.

Am I pulling the right sales levers:

There are numerous factors in store that control sales. It’s essential to quantify the impact of store conditions on sales so that you can take well-informed decisions on what SKUs to keep on shelf or what type of promotions to run. For example, are you well positioned to answer questions like:

Getting eyes in the store

Electronic point of sale (EPOS) data has long been the mainstay of any type of analysis around sales performance. While EPOS data can be very useful in certain ways, viewing that data in isolation won’t provide all the answers you need to measure ROI. To augment data models and derive actionable insight, manufacturers need also to knowing exactly what’s happening at shelf at the SKU and store level.

This is why CPGs are increasingly opting for more advanced solutions that offer true “shelf clarity”. In our recent survey of CPG executives, 79% of respondents said that they either have in place or will adopt a real-time eyes-in-store solution in the next one to three years; like Trax’s game-changing Computer Vision (CV) technology, which captures and digitizes the shelf, enabling CPGs to track every SKU in every store in real time.

One source of shelf truth with Computer Vision technology from Trax

Revisiting ROI frameworks using in-store execution data

There’s no easy answer to whether or not you’re spending the right amount of money on being in the store and whether that’s paying dividend. But new streams of intelligence like real-time in-store execution data are helping manufacturers start to build more robust ROI models.

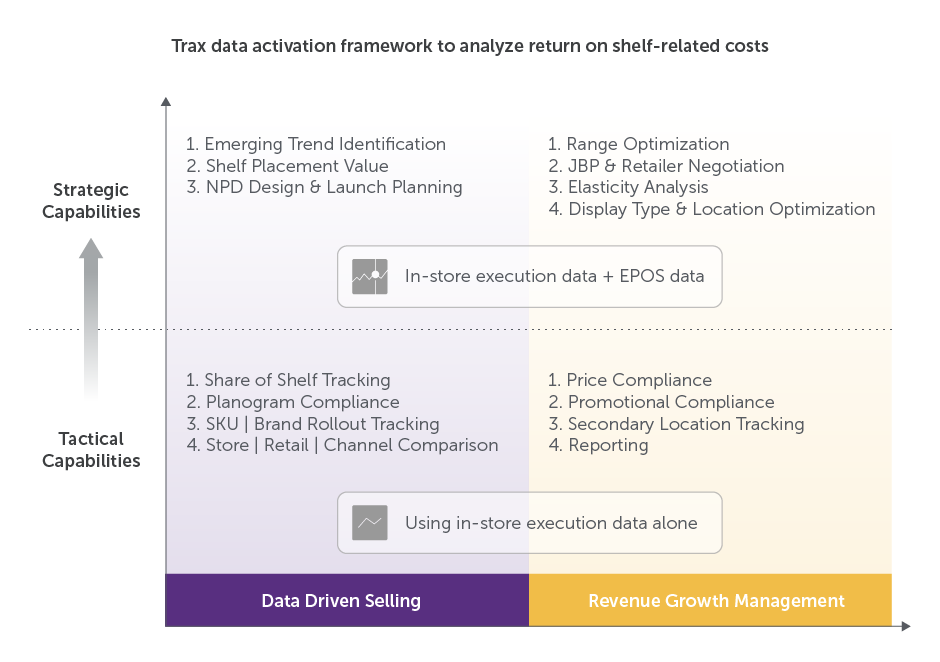

Organizing your data around specific business imperatives is a good starting point; for example, data-driven selling (how to ensure that you are directing activities and maximizing impact at the individual store level) and revenue growth management (how to use promotional dollars to drive the most effective type of activation in-store).

Here’s an illustration of a framework Trax clients use to measure and optimize their spend.

It might not be a silver bullet, but in-store execution data could be that missing piece of the puzzle that can help you re-look at how you’re measuring ROI. By monitoring everything that’s happening at the shelf and combining it with sales performance data, your team can present persuasive, data-driven arguments for better space allocation, more advantageous product placement and lower promotion fees.

To see more examples of how leading CPGs are using Trax, sign up for our on-demand webinar, “Leveraging in store execution data to build your category strategy”.

Give us some info so the right person can get back to you.