Home / Insights /

Shoppers attention span averages 8 seconds – 1 second less than a goldfish! Brands and retailers alike must get many different in-store execution levers right to convert shoppers into buyers. Teams making strategic planning decisions have access to numerous data sources to develop a perfect store strategy; but are they getting the right insights?

The Case for Right Data Vs. Big Data

The shelf is a constantly changing entity. Several events trigger major and minor shelf actions. Product or category innovation, shopper leakage, market and regulatory changes, retailer merger or acquisition – all are reasons for retailers and CPG companies to review categories periodically. Category reviews present an opportunity for CPG companies to disrupt the market; both brand and category performance depend on what products make the shelf and how they are segmented.

To understand the dynamics of shoppers across various store formats and to manage space and assortment, teams ranging from category management to shopper insights through brand management tap into POS data, household panel data, shopper loyalty card data, market data and ad-hoc consumer research. But are these data sources enough to master the category and provide retailers the insight they need to grow the category?

POS data provides sales, share and other key distribution measures, but…

Household panel data provides basket analysis and brand loyalty measures, but…

Ad-hoc shopper research adds insight into decisions, missions and loyalty, but…

In-store execution data – The missing link

We’ve spoken with strategic planners in numerous CPG organizations, and everyone has the same gap – data on what’s happening at the shelf when it happens. Manual store audits take way too long and once the data is delivered it is often incomplete, not to mention too old to be truly actionable. This creates a lacuna in analytics that directly impacts brand performance, store sales and margins.

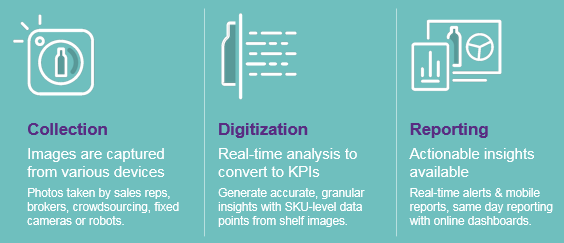

But what if you have eyes in the market at any given point in time and the ability to gain insights within minutes of execution? Technologies like Computer Vision and machine learning allow manufacturers to turn real in-store images to insights on category performance, brand health, market innovation, promotional program execution, and planogram execution.

Image to Insight with Computer Vision

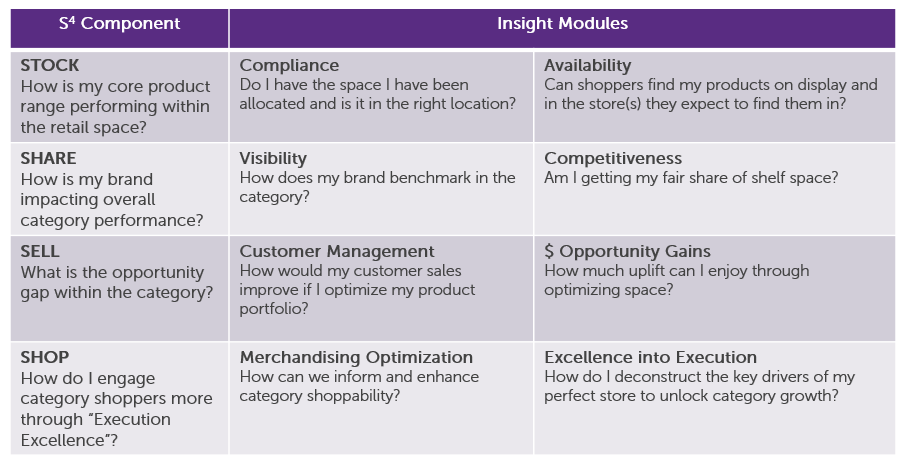

Putting shelf analytics into action: The Trax S4 Market Activation Framework

Real time in-outlet execution data can be the differentiated data source that can complete your understanding of how your products compete with others in the market. At Trax, we recommend a 4-stage circular framework to integrate this ‘missing link’ into your strategic planning process.

Trax S4 Market Activation Framework

Integrate Trax Data in Decision Making in 4 Stages

A quote by a senior category insights leader at a top pet care products company:

Trax data allows us to drive and see execution in store. There is nowhere else that you will get or see data that allows this level of decision making.

Trax data sheds light on an area that previously was a blind spot to decision makers. Having this data at near real time allows strategy adjustments, to drive performance and engage shoppers at the “moment of truth”.

To see real examples of how leading CPGs are using Trax, sign up for our on-demand webinar, “Leveraging in store execution data to build your category strategy”.

Give us some info so the right person can get back to you.